|

Introduction: Real estate investing offers a diverse range of strategies tailored to different goals, risk tolerances, and market conditions. Whether you're a seasoned investor or a newcomer to the field, understanding the various strategies can help you make informed decisions and maximize your returns. In this article, we'll explore some of the most common real estate investing strategies, ranging from traditional approaches to innovative techniques.

4. Real Estate Syndication: Real estate syndication involves pooling capital from multiple investors to collectively purchase and manage properties. Syndications are often structured as limited liability companies (LLCs) or partnerships, with one or more sponsors managing the investment on behalf of the investors. This strategy allows investors to access larger properties and diversify their portfolios while leveraging the expertise of experienced sponsors. Syndications may target various asset classes, including residential, commercial, and industrial properties, offering investors opportunities for passive income and potential tax benefits.

5. Real Estate Investment Trusts (REITs): REITs are publicly traded companies that own, operate, or finance income-generating real estate. Investors can buy shares of REITs on stock exchanges, providing liquidity and diversification compared to direct property ownership. REITs typically focus on specific sectors such as residential, retail, office, or healthcare properties, allowing investors to tailor their portfolios to their preferences. REITs offer attractive dividend yields and potential for capital appreciation, making them popular choices for income-oriented investors seeking exposure to real estate with lower barriers to entry. Conclusion: Real estate investing offers a myriad of strategies suited to different preferences and objectives. Whether you're interested in generating passive income, flipping properties for quick profits, or diversifying your portfolio with real estate assets, there's a strategy to match your goals. By understanding the various approaches and assessing your risk tolerance and investment horizon, you can make informed decisions to build wealth through real estate investing.

0 Comments

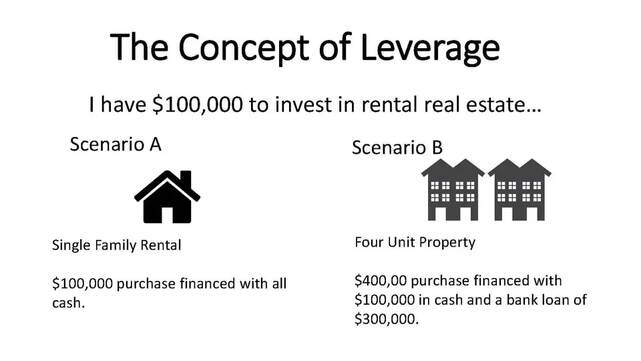

Rehabbing rental properties can be a lucrative investment strategy, but it requires a reliable team of contractors to ensure the job gets done efficiently and to a high standard. Finding trustworthy contractors can sometimes feel like searching for a needle in a haystack, but with the right approach, you can assemble a team that will help you maximize the value of your rental properties. Here's a comprehensive guide on how to find good contractors for your rehab projects: 1. Referrals and Recommendations One of the most effective ways to find reliable contractors is through referrals from trusted sources. Reach out to fellow real estate investors, property managers, or local real estate associations for recommendations. Personal referrals often come with firsthand experiences and insights, helping you identify contractors who have a track record of delivering quality work. 2. Online Platforms and Reviews Utilize online platforms such as Angie's List, HomeAdvisor, or Yelp to search for contractors in your area. These platforms provide reviews and ratings from previous clients, allowing you to gauge the reputation and reliability of potential contractors. Pay attention to both positive and negative reviews, and consider reaching out to contractors with consistently high ratings and positive feedback. 3. Contractor Directories Explore contractor directories provided by trade organizations or local government agencies. These directories typically list licensed and accredited contractors, providing you with a pool of professionals who meet certain standards of competency and professionalism. Verify credentials and licenses before engaging with any contractor listed in these directories. 4. Networking Events and Trade Shows Attend networking events, trade shows, and industry conferences where you can connect with contractors and subcontractors in person. These events provide opportunities to establish relationships, ask questions, and assess the expertise of potential contractors. Building a network of reliable professionals within the industry can be invaluable for future rehab projects. 5. Screening and Interviews Once you've compiled a list of potential contractors, conduct thorough screening and interviews to assess their qualifications and suitability for your project. Ask for references and past project portfolios to evaluate the quality of their workmanship. Inquire about their experience with rehabbing rental properties specifically, as this requires a unique set of skills and understanding of landlord-tenant dynamics. 6. Get Multiple Bids Request bids from multiple contractors for your rehab project to compare pricing, timelines, and proposed scope of work. Be wary of bids that are significantly lower than others, as they may indicate potential quality issues or hidden costs down the line. Choose contractors who provide detailed and transparent estimates, outlining all aspects of the project. 7. Contracts and Agreements Once you've selected a contractor, formalize the agreement with a written contract that clearly outlines the scope of work, project timeline, payment schedule, and any other relevant terms and conditions. Ensure that the contract includes provisions for quality assurance, dispute resolution, and compliance with local regulations. 8. Communication and Oversight Maintain open lines of communication with your contractor throughout the rehab process. Regularly check in on the progress of the project and address any concerns or issues promptly. Establish clear expectations regarding timelines, milestones, and quality standards to ensure that the project stays on track. Conclusion Finding good contractors to rehab rental properties requires diligence, research, and careful consideration. By leveraging referrals, online resources, networking opportunities, and thorough screening processes, you can assemble a team of reliable professionals who will help you achieve your investment goals. Remember that investing time and effort upfront to find the right contractors can ultimately save you time, money, and headaches in the long run, leading to successful and profitable rehab projects. In the realm of investment opportunities, few avenues offer the potential for wealth accumulation and financial security quite like real estate. While various investment options exist, real estate stands out as a superior choice, primarily due to the strategic use of leverage. In this article, we'll delve into why leverage makes real estate investing a formidable wealth-building strategy. Understanding Leverage: Leverage, in the context of real estate investing, refers to the practice of using borrowed capital to increase the potential return on investment. This borrowed capital typically comes in the form of a mortgage loan, where an investor can purchase a property with a relatively small down payment and finance the rest through a lender. By leveraging their investment with debt, investors can amplify their returns, thereby maximizing their profit potential. Appreciation Amplified: One of the key advantages of leverage in real estate investing is its ability to magnify the effects of property appreciation. When you purchase a property using leverage, you're essentially controlling a larger asset value with a smaller amount of your own capital. As the property appreciates in value over time, the increase in equity is not just on the initial investment but on the total property value. This means that even a modest increase in property value can result in significant returns on your initial investment. Cash Flow Optimization: Leverage also enhances cash flow potential in real estate investments. By using borrowed funds to acquire properties, investors can generate rental income that exceeds their mortgage payments, operating expenses, and other carrying costs. This positive cash flow can provide a steady stream of passive income, allowing investors to recoup their initial investment more quickly and potentially reinvest profits into additional properties. Risk Mitigation: Contrary to common misconceptions, leverage can actually serve as a risk mitigation tool in real estate investing. By spreading your investment capital across multiple properties, you can diversify your portfolio and reduce the impact of any single property underperforming. Additionally, fixed-rate mortgages offer protection against rising interest rates, providing stability and predictability in cash flow management. Tax Advantages: Real estate investors also benefit from a myriad of tax advantages, further enhancing the appeal of leveraging in this asset class. Mortgage interest, property taxes, depreciation, and other expenses associated with owning and managing real estate are often tax-deductible. Moreover, through strategies like 1031 exchanges, investors can defer capital gains taxes when reinvesting proceeds from one property into another, allowing for continued growth and wealth accumulation. Long-Term Wealth Creation: Perhaps the most compelling argument for leveraging in real estate investing is its potential for long-term wealth creation. Over time, as properties appreciate in value and mortgages are paid down, investors can build substantial equity and wealth. This equity can be tapped into through refinancing or selling properties, providing liquidity for future investments or other financial goals. Conclusion: Leverage serves as a powerful catalyst for wealth creation in real estate investing. By intelligently utilizing borrowed capital, investors can amplify their returns, optimize cash flow, mitigate risks, and benefit from various tax advantages. While leverage can magnify both gains and losses, when employed prudently and with a long-term perspective, it can unlock unparalleled opportunities for financial success. As such, real estate investing stands as a superior investment choice, offering the potential for significant returns and lasting wealth.

|

ABOUT THE AUTHOR: ADAM CRAIG Adam Craig: Founding member of CLE Real Estate Group.

With more than a decade of experience and 12 million under management in residential and commercial real estate, Adam is a top an industry expert. Archives

July 2024

|