|

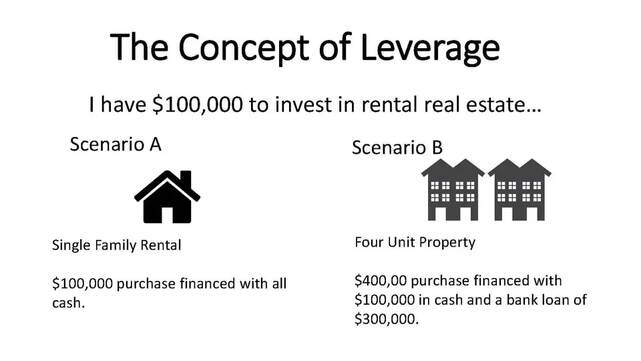

In the realm of investment opportunities, few avenues offer the potential for wealth accumulation and financial security quite like real estate. While various investment options exist, real estate stands out as a superior choice, primarily due to the strategic use of leverage. In this article, we'll delve into why leverage makes real estate investing a formidable wealth-building strategy. Understanding Leverage: Leverage, in the context of real estate investing, refers to the practice of using borrowed capital to increase the potential return on investment. This borrowed capital typically comes in the form of a mortgage loan, where an investor can purchase a property with a relatively small down payment and finance the rest through a lender. By leveraging their investment with debt, investors can amplify their returns, thereby maximizing their profit potential. Appreciation Amplified: One of the key advantages of leverage in real estate investing is its ability to magnify the effects of property appreciation. When you purchase a property using leverage, you're essentially controlling a larger asset value with a smaller amount of your own capital. As the property appreciates in value over time, the increase in equity is not just on the initial investment but on the total property value. This means that even a modest increase in property value can result in significant returns on your initial investment. Cash Flow Optimization: Leverage also enhances cash flow potential in real estate investments. By using borrowed funds to acquire properties, investors can generate rental income that exceeds their mortgage payments, operating expenses, and other carrying costs. This positive cash flow can provide a steady stream of passive income, allowing investors to recoup their initial investment more quickly and potentially reinvest profits into additional properties. Risk Mitigation: Contrary to common misconceptions, leverage can actually serve as a risk mitigation tool in real estate investing. By spreading your investment capital across multiple properties, you can diversify your portfolio and reduce the impact of any single property underperforming. Additionally, fixed-rate mortgages offer protection against rising interest rates, providing stability and predictability in cash flow management. Tax Advantages: Real estate investors also benefit from a myriad of tax advantages, further enhancing the appeal of leveraging in this asset class. Mortgage interest, property taxes, depreciation, and other expenses associated with owning and managing real estate are often tax-deductible. Moreover, through strategies like 1031 exchanges, investors can defer capital gains taxes when reinvesting proceeds from one property into another, allowing for continued growth and wealth accumulation. Long-Term Wealth Creation: Perhaps the most compelling argument for leveraging in real estate investing is its potential for long-term wealth creation. Over time, as properties appreciate in value and mortgages are paid down, investors can build substantial equity and wealth. This equity can be tapped into through refinancing or selling properties, providing liquidity for future investments or other financial goals. Conclusion: Leverage serves as a powerful catalyst for wealth creation in real estate investing. By intelligently utilizing borrowed capital, investors can amplify their returns, optimize cash flow, mitigate risks, and benefit from various tax advantages. While leverage can magnify both gains and losses, when employed prudently and with a long-term perspective, it can unlock unparalleled opportunities for financial success. As such, real estate investing stands as a superior investment choice, offering the potential for significant returns and lasting wealth.

0 Comments

Leave a Reply. |

ABOUT THE AUTHOR: ADAM CRAIG Adam Craig: Founding member of CLE Real Estate Group.

With more than a decade of experience and 12 million under management in residential and commercial real estate, Adam is a top an industry expert. Archives

July 2024

|