|

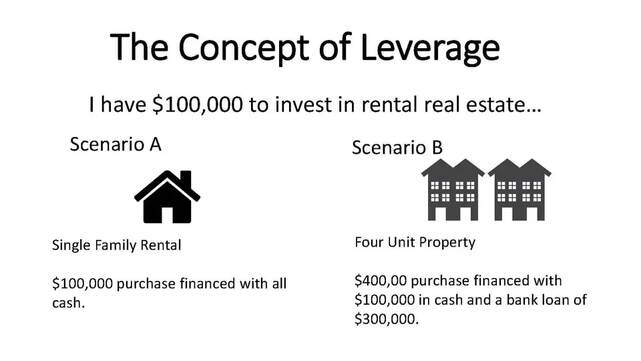

In the realm of investment opportunities, few avenues offer the potential for wealth accumulation and financial security quite like real estate. While various investment options exist, real estate stands out as a superior choice, primarily due to the strategic use of leverage. In this article, we'll delve into why leverage makes real estate investing a formidable wealth-building strategy. Understanding Leverage: Leverage, in the context of real estate investing, refers to the practice of using borrowed capital to increase the potential return on investment. This borrowed capital typically comes in the form of a mortgage loan, where an investor can purchase a property with a relatively small down payment and finance the rest through a lender. By leveraging their investment with debt, investors can amplify their returns, thereby maximizing their profit potential. Appreciation Amplified: One of the key advantages of leverage in real estate investing is its ability to magnify the effects of property appreciation. When you purchase a property using leverage, you're essentially controlling a larger asset value with a smaller amount of your own capital. As the property appreciates in value over time, the increase in equity is not just on the initial investment but on the total property value. This means that even a modest increase in property value can result in significant returns on your initial investment. Cash Flow Optimization: Leverage also enhances cash flow potential in real estate investments. By using borrowed funds to acquire properties, investors can generate rental income that exceeds their mortgage payments, operating expenses, and other carrying costs. This positive cash flow can provide a steady stream of passive income, allowing investors to recoup their initial investment more quickly and potentially reinvest profits into additional properties. Risk Mitigation: Contrary to common misconceptions, leverage can actually serve as a risk mitigation tool in real estate investing. By spreading your investment capital across multiple properties, you can diversify your portfolio and reduce the impact of any single property underperforming. Additionally, fixed-rate mortgages offer protection against rising interest rates, providing stability and predictability in cash flow management. Tax Advantages: Real estate investors also benefit from a myriad of tax advantages, further enhancing the appeal of leveraging in this asset class. Mortgage interest, property taxes, depreciation, and other expenses associated with owning and managing real estate are often tax-deductible. Moreover, through strategies like 1031 exchanges, investors can defer capital gains taxes when reinvesting proceeds from one property into another, allowing for continued growth and wealth accumulation. Long-Term Wealth Creation: Perhaps the most compelling argument for leveraging in real estate investing is its potential for long-term wealth creation. Over time, as properties appreciate in value and mortgages are paid down, investors can build substantial equity and wealth. This equity can be tapped into through refinancing or selling properties, providing liquidity for future investments or other financial goals. Conclusion: Leverage serves as a powerful catalyst for wealth creation in real estate investing. By intelligently utilizing borrowed capital, investors can amplify their returns, optimize cash flow, mitigate risks, and benefit from various tax advantages. While leverage can magnify both gains and losses, when employed prudently and with a long-term perspective, it can unlock unparalleled opportunities for financial success. As such, real estate investing stands as a superior investment choice, offering the potential for significant returns and lasting wealth.

0 Comments

In the realm of investment opportunities, few avenues offer the potential for significant returns quite like real estate. Whether you're a seasoned investor or just dipping your toes into the market, understanding Return on Investment (ROI) is paramount for success. In this article, we'll delve into the intricacies of ROI in real estate investing, exploring its significance, calculation methods, and strategies to optimize returns. What is ROI in Real Estate? Return on Investment (ROI) is a key metric used to evaluate the profitability of an investment relative to its cost. In real estate, ROI measures the efficiency of an investment property by comparing the income it generates to the amount invested. Essentially, it quantifies the return earned on the capital invested in the property. Calculating ROI in Real Estate: The formula for calculating ROI in real estate is straightforward: ROI = (NET INCOME) / (TOTAL INVESTMENT) x 100%

Conclusion: In the dynamic world of real estate investing, understanding ROI is paramount for making informed decisions and maximizing returns. By accurately calculating ROI, assessing investment opportunities, and implementing effective strategies, investors can navigate the market with confidence and unlock the full potential of their real estate investments. Remember, while ROI is a critical metric, it's just one piece of the puzzle in building a successful and profitable real estate portfolio.

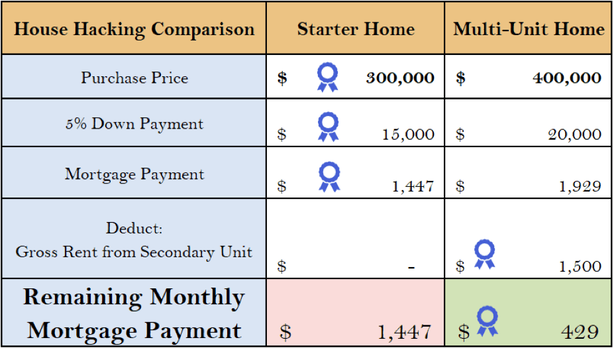

Are you intrigued by the idea of real estate investing but feel overwhelmed by the complexities? If so, you're not alone. Many aspiring investors find themselves daunted by the prospect of purchasing properties, managing tenants, and navigating the intricacies of the housing market. However, there's a simple and accessible strategy that can help you overcome these barriers and kickstart your real estate investment journey: house hacking. What is House Hacking? House hacking involves purchasing a multifamily property, living in one unit, and renting out the remaining units to tenants. By doing so, you can offset—or even eliminate—your housing expenses while simultaneously building equity and generating rental income. In essence, house hacking allows you to leverage real estate to achieve financial freedom while minimizing your out-of-pocket expenses. Why House Hacking is the Easiest Way to Get Started

In Conclusion. House hacking offers a straightforward and accessible entry point into real estate investing, allowing you to leverage homeownership to build wealth and achieve financial independence. By living in one unit and renting out the others, you can reduce your living expenses, generate passive income, and gain valuable hands-on experience as a property owner. With careful planning, diligent research, and a willingness to take action, house hacking can serve as a springboard for your real estate investment journey, paving the way toward long-term financial success. |

ABOUT THE AUTHOR: ADAM CRAIG Adam Craig: Founding member of CLE Real Estate Group.

With more than a decade of experience and 12 million under management in residential and commercial real estate, Adam is a top an industry expert. Archives

July 2024

|